Medicare Costs Spike After Menopause—Here's How to Stop It

You’ve saved for retirement. Then Medicare sends a bill that makes your stomach drop. Everyone else pays $185 a month, but your premium is $259? Or $629? What happened?

INSIDE THIS ISSUE

What IRMAA actually is (and why it punishes savers)

The exact income numbers that trigger higher Medicare costs

Why menopause timing makes this worse—and how to fix it

WHAT IS IRMAA?

IRMAA stands for Income-Related Monthly Adjustment Amount. Simple concept: if you made “too much” money, Medicare makes you pay more for health insurance.

Most people on Medicare pay around $185 monthly for Part B coverage in 2025. But if your income crosses certain thresholds, the government tacks on a surcharge. Sometimes a big one.

Here’s the kicker: only about 7% of Medicare beneficiaries pay IRMAA surcharges. Most people don’t know it exists until they get the bill.

WHAT INCOME TRIGGERS IRMAA?

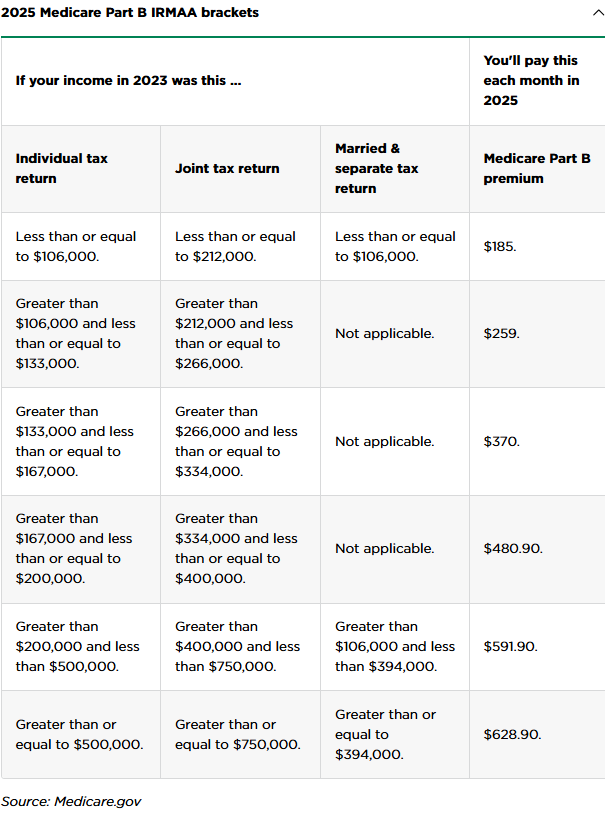

The numbers for 2025:

For single filers: Income over $106,000 in 2023 triggers IRMAA in 2025 NerdWallet.

For married couples filing jointly: The threshold is $212,000.

Notice the two-year delay? Your 2025 Medicare premium is based on your 2023 income. That big bonus you got back then? You’re paying for it now.

The surcharges work in brackets. Cross that first threshold and your Part B premium jumps from $185 to $259 monthly. Go higher and you could hit $629 monthly at the top bracket.

The real kicker: it’s a cliff, not a ramp. Go over the threshold by one dollar and you pay the full surcharge for the entire year.

Part D prescription drug coverage has separate IRMAA surcharges ranging from about $14 to $86 monthly Kiplinger. So if you’re paying both Part B and Part D surcharges, it adds up fast.

HOW MANY YEARS DOES IRMAA LAST?

IRMAA only lasts one year at a time. Medicare recalculates annually based on your income from two years prior. If 2023 was a high-income year but 2024 wasn’t, your IRMAA automatically drops in 2026. No forms needed.

Had a one-time spike from selling a house or cashing out stock options? You’ll pay IRMAA for that one year, then it’s over.

But if your income stays high year after year, IRMAA sticks around. It recalibrates annually based on your tax return from two years ago.

WHY THIS MATTERS FOR MENOPAUSAL WOMEN

The timing is brutal.

Most women hit menopause in their late 40s to mid-50s—peak earning years. You’re dealing with brain fog, sleepless nights, and hot flashes while trying to maximize income before retirement.

Then you hit your early-to-mid 60s and start Medicare. Those years when you pushed through menopause symptoms while still earning good money? Now you’re paying for it in higher Medicare premiums.

You got penalized twice. First, you fought through menopause to keep earning. Now, Medicare charges you extra because you succeeded.

Plus, menopause comes with unexpected medical costs. Hormone therapy. Specialist visits. Sleep doctors. Bone density scans. You might take a bigger retirement distribution to cover these costs. Then two years later, IRMAA shows up because that income pushed you over the threshold.

Women in my practice constantly tell me they wish someone had warned them about this connection.

THREE MOVES TO AVOID IRMAA

1. Spread Out Big Money Moves

Don’t take all your income in one year:

Sell half a property one year, half the next

Take smaller IRA distributions over several years

Split stock sales across different tax years

Time bonuses to land in lower-income years

You still get the money—you’re just being strategic about timing to stay below IRMAA thresholds.

2. Build Up Roth Accounts Early

Money from a Roth IRA doesn’t count toward IRMAA. It’s invisible to Medicare’s income calculations. If you’re in your 50s or early 60s:

Convert traditional IRA money to Roth before Medicare starts (you’ll pay taxes on conversion, but no IRMAA)

Use Roth withdrawals during Medicare years for big expenses—zero IRMAA impact

Convert more during low-income years (right after retirement, before Social Security)

Women tell me this is the strategy they wish they’d started earlier.

3. Watch Your Income Once You’re on Medicare

Think two years ahead with every financial decision:

Make charitable donations to lower your adjusted gross income

Harvest investment losses to offset gains

Pull from Roth accounts instead of traditional IRAs

Don’t stack high-income events (selling house AND big IRA withdrawal in same year)

Use qualified charitable distributions from your IRA after age 70½ (doesn’t count as income)

If you need extra cash one year, check whether you can delay it to a year with less other income.

Share this with three women approaching Medicare age—or who just got their first IRMAA notice. Understanding this early keeps thousands in your pocket instead of vanishing into higher premiums.